To give crypto quality signals, experts keep an eye on various aspects. The various aspects include the market situation, crypto news, or different rumors that can influence the price. These experts are responsible for giving signals about buying, selling, or exchanging the crypto.

When there is the perfect time to buy or invest, they give the signal to the trader. The trader buys, sells, or exchanges the currency. If they pick up the crypto signals at the right time, they will make a significant profit. Most of the traders will be able to automate these signals by creating their own trading script, which will give the command when to enter or exit the trade.

To offer these valuable trading signals, most of the companies require a monthly fee and offer usually 3-5 signals per week. But there are some companies too that offer free signals. Unfortunately, they aren’t consistent and the quality is also poor. To make the most out of trading signals traders require detailed statistics of the past trades. In WunderTrading’s Trading marketplace all users will be able to see the transparent track history for all traders and their bots and trade as professional by using crypto copy trading.

The most common crypto trade signals are bitcoin-signals. Bitcoins are the most used cryptocurrency in the world, so most of the organizations offer bitcoin signals and some of them accept payment in these coins form. At the same time, in comparison to other crypto assets, bitcoin has a larger liquidity pool, which will decrease the chance of slippage while entering or exiting the trade. Similar crypto signals can be applied to the variety of crypto assets or crypto derivatives and automated through crypto bot trading.

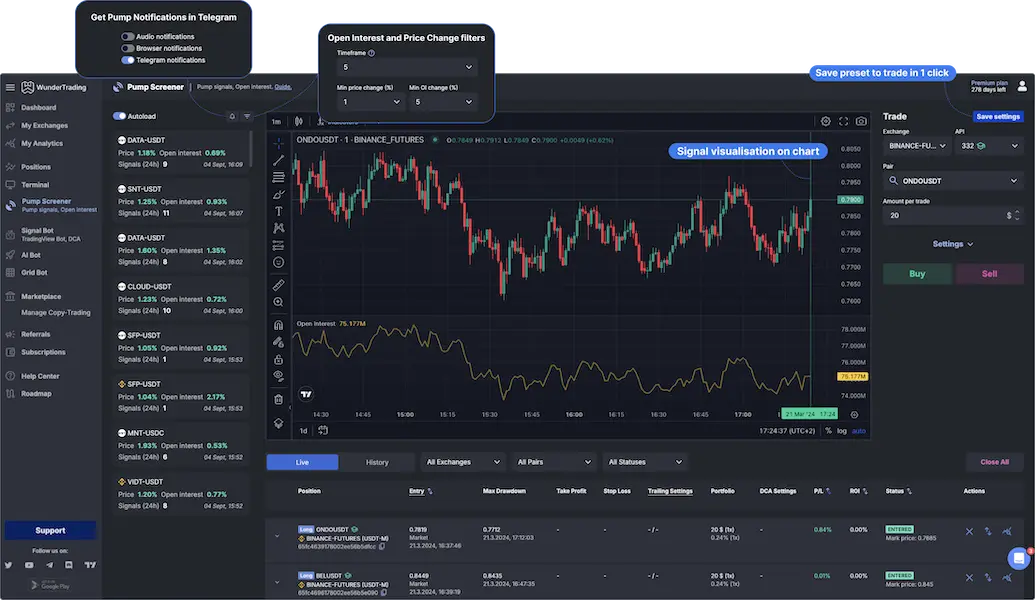

Pump bots in the crypto futures markets are designed to capitalize on rapid movements by artificially inflating the price of cryptocurrencies, with the aim of generating quick profits. These bots, including crypto pump bot, smart bot pump, and Bitcoin pump bot, utilize complex algorithms to analyze market trends, such as open interest signals, to determine the optimal times to buy or sell. For instance, a smart bot pump might interpret a surge in open interest as a precursor to a significant price move, triggering a sequence of trades that exploit this momentum. These bots often work by gathering pump signals, which are essentially prompts or indicators that suggest an imminent price pump, to coordinate their actions for maximum effect.

Crypto screeners are like special search tools for people who trade cryptocurrencies, helping them find the best times to buy or sell. Imagine a tool called a crypto pump screener or a pump and dump screener; it looks through the market to find cryptocurrencies that are about to increase in price quickly. These screeners can show when a lot of people are buying a certain cryptocurrency, which might mean its price will go up soon. This is often seen with a crypto volume scanner, which checks how much of a cryptocurrency is being traded. There's also something called a crypto market scanner and a crypto pump scanner that help traders see overall market trends or specific moments when a cryptocurrency's price might shoot up. A cryptocurrency screener can pick out specific coins that might be good to trade, while a crypto coin screener focuses even more closely on certain types of coins. A crypto market screener gives an overview of what's happening in the market, and a volatility screener helps find cryptocurrencies whose prices go up and down a lot, which can be opportunities to make money. By using these tools, traders can get hints or trading signals for when to buy or sell to try to make a profit.