-

Features

-

Trading Bots

- Pricing

-

Blog

Traders

Bots

30-day Volume

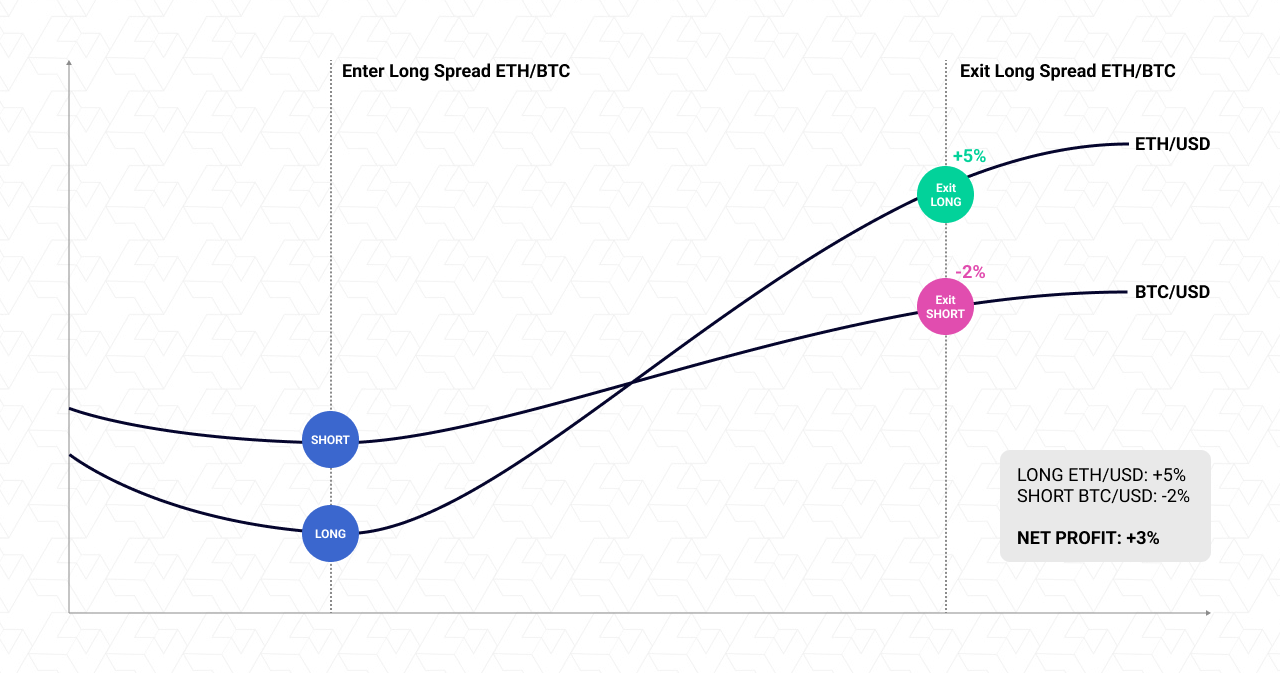

Futures Spread trading is a trading method that involves simultaneously opening two positions in opposing directions: you establish one trade with a specified amount in one way and another with the same amount in the opposite direction. The spread refers to the price differential between the two positions. A trader essentially trades the differences between these two assets rather than the item itself.

On most exchanges, one crypto asset is traded against another crypto asset. For example, Bitcoin spread trading against Ethereum, or USDT. The main reason for this is the way the crypto space has evolved: using fiat currencies such as USD and EUR requires exchanges to comply with much stricter legal requirements. Therefore, most exchanges use cryptocurrencies as the quote currency.

Cross-pair trading allows you to profit from the spread by buying and holding the stronger coin while selling the weaker one. Although trading low-liquidity assets is more expensive, futures spread trading software can help you overcome this by allowing you to leverage your position and increase the size of your position. Derivatives Markets Spread Trading.

The crypto derivatives market has grown exponentially in recent years. The trading volume in these markets exceeds the volume of spot trading several times. Moreover, derivatives markets demonstrate higher volatility, which makes them a more attractive environment for applying advanced spread strategies in futures trading.

In crypto, there are two forms of futures spread trading. To begin, you may construct a spread between two separate crypto assets or futures, such as ETH/BTC. This is quite similar to trading stock spreads. Nevertheless, you can trade futures spreads with multiple maturities for the same asset. The calendar spread trading strategy is another name for this method. WunderTrading offers spread trading.

To use WunderTrading to perform crypto futures trading strategies, navigate to the Terminal tab and choose the Spread Trading Terminal. You will then be able to choose the Base and Quote pairs. The chart will then display a horizontal channel. You may then choose whether to go Long or Short by pressing the respective option. Finally, pick the portfolio share that will be utilized in the strategy, set the Take Profit and Stop Loss levels, and click Create a Strategy.

When the binance futures spread strategy is created, you can monitor it in the Spread Trading sub-tab of the Positions tab. There you will see live statistics on your position and can manage it manually. You can manage your multi-leg positions or edit its settings, such as Take Profit or Stop Loss.

WunderTrading gives you a full spectrum of instruments that will allow you to start investing in and trading cryptocurrencies. Our platform supports all major crypto exchanges and trading pairs. We provide you with a system that will execute your trades in a fast and reliable way, as well as an infrastructure that will enable you to track your crypto portfolio and maximize gains.

You may trade manually using our powerful Terminal, copy-trade best traders on our Marketplace, or develop a fully-automated robot that will execute trades depending on the settings you put up on WunderTrading. Spread Trading methods can help you achieve all of these goals.