-

Features

-

Trading Bots

- Pricing

-

Blog

Traders

Bots

30-day Volume

A Crypto GRID Trading Bot works by using algorithms to analyze market data and make trades based on predetermined rules and conditions. The bot will analyze market trends, identify profitable opportunities, and execute trades automatically. This allows traders to take advantage of market fluctuations without having to constantly monitor the market.

When grid trade, every buy order will place a sell order. If you have 4 buy orders, a total of 4 sell orders will be placed. Therefore the spot grid trading bot will place the grid of limit orders scattered at the same distance from each other. As soon as the target is reached the bot will close the position and will automatically open another limit order. The Grid robot has a continuous closed loop of work. In other words, once the robot closes all sell orders, it will place a new buy order and start a new cycle.

When trading with a Crypto Grid Trading Bot, you may employ a variety of techniques. Among the most prevalent strategies are

Trend Following This approach entails purchasing into an upward trend or selling into a negative trend and following the general market trend. The idea is to profit from the market's general price change.

Mean Reversion This strategy involves buying into a cryptocurrency that has been oversold, or selling a cryptocurrency that has been overbought. The goal is to profit from the return of the price to its average level.

Scalping This strategy involves making small, quick trades to profit from small price movements. Scalping is often used in high-volatility markets and requires a fast and accurate trading bot.

Market Making This strategy involves continuously buying and selling a cryptocurrency to profit from the spread between the buy and sell price. Market makers use algorithms to continuously monitor the market and make trades to take advantage of the spread.

Arbitrage This strategy involves taking advantage of price differences between different exchanges. An arbitrage bot will continuously monitor the prices on multiple exchanges and make trades to profit from any price differences.

These are just a few of the strategies that can be used with a Crypto Grid Trading Bot. It is important to carefully consider your trading goals and risk tolerance before choosing a strategy and to continually monitor and adjust your strategy as market conditions change.

First of all, you will need to identify the trading range of the asset in the crypto market, selecting the lower price limits and upper limits of that price range, to determine the trading grid. Then you need to determine the entry point, the trading volume of the first order and additional orders, the take profit percentage, and the price step of additional orders. These parameters will change based on price fluctuations.

Grid trading crypto bots can use different indicators to determine the entry point and the channel range like Bollinger, RSI, and/or MACD indicators. If you do not use any signals, the robot will continuously place orders and start a new trading cycle immediately after the last sell order is executed based on the previous settings. If you do not have enough time or experience to trade with the grid bot then your best option will be to use the crypto copy trading platform to assist you with trading.

When developing a bot trading script, you must also set the stop loss level to construct the fully automated grid approach. When the unrealized loss exceeds the value you specify in the stop loss column, the stop loss is activated, and the robot sells the unsold currency at market value. The robot will cease selling if the stop loss is reached. Some of the exchanges will provide a free grid trading bot. Exchanges such as Kucoin and Binance futures grid bot.

Once you have chosen a Crypto Grid Trading Bot, the next step is to set it up. This typically involves:

1. Creating an account with the bot

2. Connecting the bot to your exchange account

3. Setting up your trading rules and conditions

4. Activating the bot to start trading

A spot grid bot is one method by which individuals trade cryptocurrency automatically. It works by placing a grid of buy and sell orders at specific prices in order to profit when the market rises and falls. This bot is utilised in the spot market, where items are purchased and sold in real time. Traders can profit from price changes in the market by employing this grid of orders.

The GRID strategy can also be used in the futures markets which are mainly used in the futures market especially in the case of cryptocurrency trading there is futures grid bot. This type of bot works by setting up a grid of buy and sell orders in the futures market at certain prices. Futures trading is a contract for purchase or sale of an asset at a given price at a future date as opposed to spot trading where assets are bought and sold instantly. The futures grid bot is designed specifically for generating profits from the price changes in the futures market. It does this by employing the grid method to make money off of market movements and the direction of those movements.

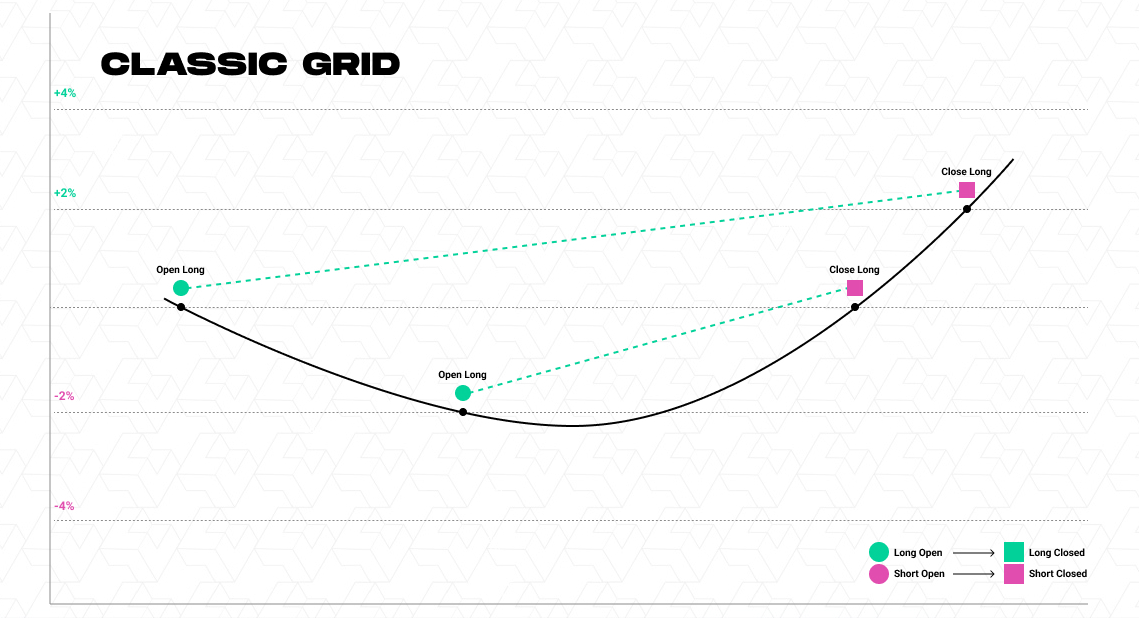

A Classic Grid bot (in other words, one-way Grid bot) is a trading automation tool applied in different markets, including cryptocurrency trading. This type of bot works by setting a grid of buy or sell orders only on one side of the market. A bidirectional or two-way grid bot places both the buy and sell orders at once, whereas a one-way grid bot aims to earn from a single market trend.

For instance, a one way Grid bot can place a sequence of buy orders at certain price levels during a rising market with the aim of making a profit from the price rise. However, it can also place sell orders in a falling market to make a profit from the declining price action. It enables the bot to act on the market movements and generate profits depending on the chosen directed approach using the order grid.

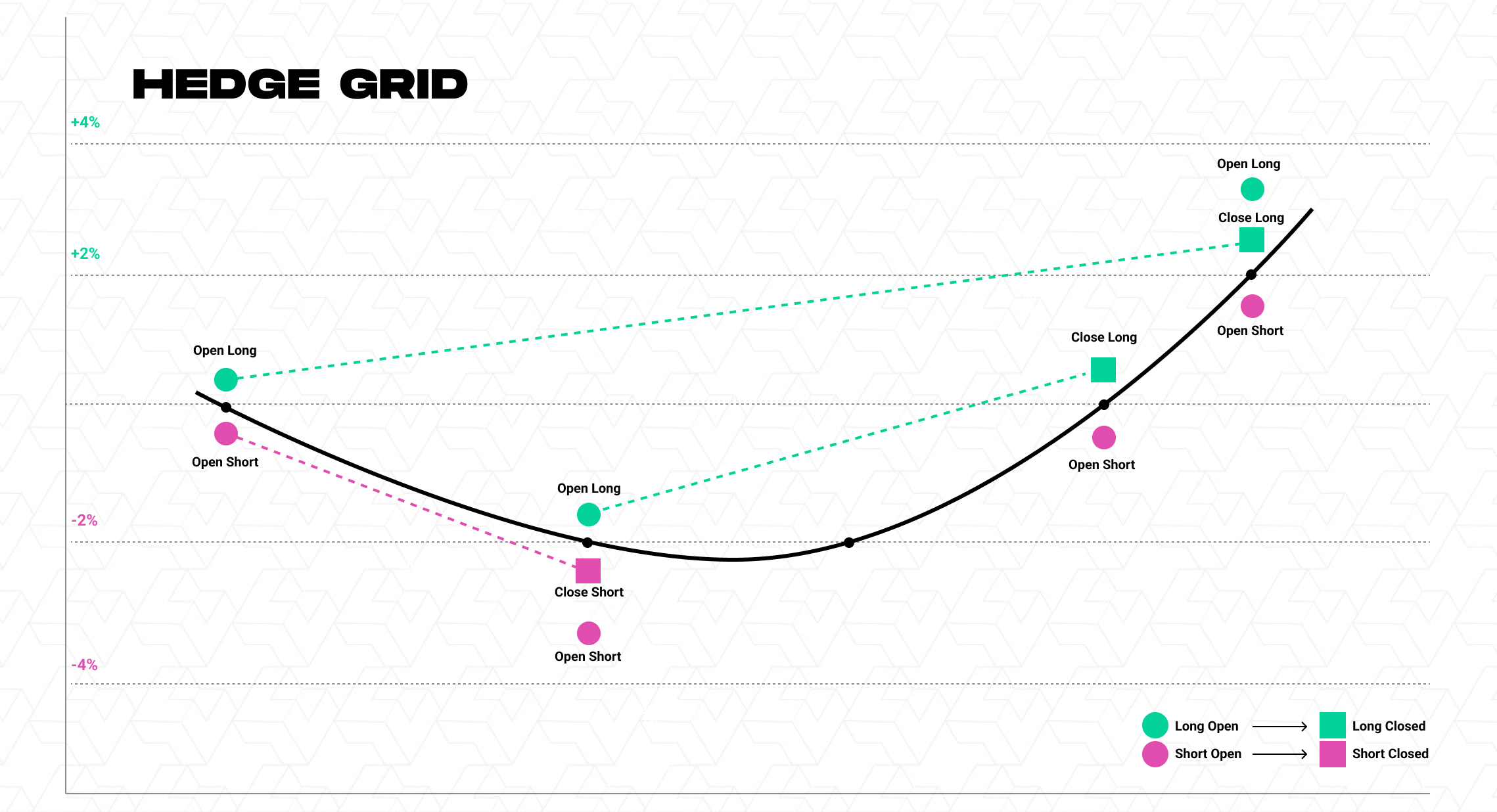

This type of trading bot include hedge Grid strategy and operates by placing a grid of both buy and sell orders at predefined price levels above and below the current market price.

The main characteristics of a two-way grid bot are:

Bi-directional Grid A classic grid bot only buys or sells the market,

while a two-way grid bot places both buy orders and sell orders at the same level.

Profit from Price Oscillations The purpose of the two-way grid bot is to

make money from price movements within the grid intervals that are set. The bot is

able to execute trades at different price levels as the market moves, in an attempt to

make money from the oscillations.

Dynamic Adjustment The two-way grid bot has the ability to adapt to

market conditions by adding or removing orders from the grid. This adaptability of the

bot enables it to compensate for changing price trends.

Risk Management Risk managers are traders who incorporate risk control features in two-way grid

bots to prevent overexposure and minimize the risks of incurring large losses.

Appropriate For Range-Bound Markets Two way grid bots are most appropriate in

markets that are range bound, where prices tend to move between clearly defined

levels.

Continuous Operation The bot works around the clock, tracking market

activities and making trades based on the grid strategy set for it. This is because it is

run continuously to take advantage of market price changes that are frequent.

Traders use two-way grid bots to automate trading, reduce the role of manual

intervention and implement systematic approaches to manage market volatility.

However, as with any trading robot, it is important for the traders to test the

effectiveness of the two-way grid bot and monitor its performance in different

market conditions.

A grid bot is a type of trading robot that is widely used in the cryptocurrency markets today. Such kind of bot is designed to set up a grid of buy and sell orders at certain price intervals. An interval is the predefined price levels on which the bot is going to make the trades.

The major aim of an interval grid bot is to make a profit from the price changes that

occur within the intervals. The bot does this by buying and selling assets at regular

intervals as the market rises or falls.

This method can be employed by traders to take a systematic approach to trading and make

profits from market volatility within known parameters. Interval grid bots work best in

range bound markets where the price will move between certain levels.

An infinity grid bot is a trading robot typically employed in the cryptocurrency

markets. This kind of bot makes a grid of buy and sell orders at different prices,

above and below the market price. A finite grid has a fixed number of orders, while

an infinite grid bot has the ability to update and expand the number of orders as the market

moves.

The major feature of an infinite grid bot is that it is able to work without a pre-defined

number of grid levels and to respond to the changes in the market. The bot works

actively – it adjusts the grid and places new orders when the market moves.

The infinite grid bot is designed to make a profit from the range bound market

conditions regardless of the market trend. This strategy is commonly employed in

markets that are volatile and have price action that is volatile and unpredictable.

A grid bot backtest is the process of modelling the performance of a grid trading strategy using

historical market data to determine how the strategy would have performed in the past.

It is important to note that while backtests are very useful, they are based on the historical

data and the strategy performance. This is because market conditions may differ in the

future. It is therefore important that backtesting is incorporated into the strategy

development process for traders and that they exercise caution when using the

historical performance in the current trading decisions.