-

Features

-

Trading Bots

- Pricing

-

Blog

-

Coins

A crypto pump bot is a clever piece of software crafted for the crypto trading world. It helps traders by taking over the job of making buy or sell decisions based on specific signals from the market. These bots are designed to spot good trading moments by following rules set by the trader, aiming for profit without engaging in any shady price manipulation.

Key Features: These bots are packed with abilities to quickly sift through market data, make trades automatically to snatch up advantageous prices, and let traders tailor their own strategies to fit what they're comfortable with.

Benefits: The biggest perks include making trading a lot smoother by cutting down on the need to watch the market non-stop, ensuring quick actions that might be too fast for a human, and helping keep those gut-reaction trades that can lead to mistakes at bay.

Crypto pump bots operate by employing complex algorithms that sift through extensive market data to spot signs of imminent price increases. By setting parameters that define what constitutes a significant movement or trend, these bots can automatically execute buy or sell orders to take advantage of market conditions.

Data Analysis: The bot analyzes real-time data such as sudden increases in trading volume or rapid price movements. It uses historical data to predict future market movements accurately.

Strategy Execution: Once a potential opportunity is identified, the bot can automatically execute trades on behalf of the user, following the strategies set by the trader. This includes determining the right time to enter or exit a trade to maximize gains.

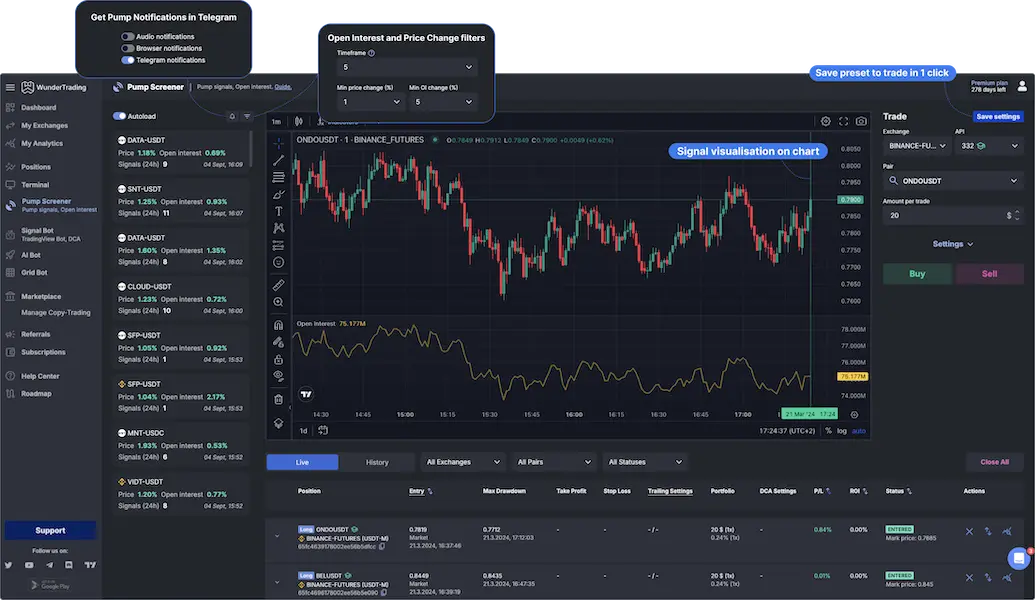

Identifying a potential crypto pump relies on interpreting key market indicators that signal a significant increase in an asset's price. Tools designed for this purpose, like a bitcoin pump bot or pump screener, help traders filter out the noise and focus on assets that show real potential for rapid growth.

Volume Increase: An abrupt rise in trade volume can indicate growing interest among traders and investors, often preceding price surges.

Price Movement: Observing unusual upward trends in price can indicate a pump. Traders use technical analysis tools to spot these trends early.

Open interest represents the total number of outstanding contracts that are held by market participants at the end of each trading day. It serves as an indicator of the flow of money into the futures market and can provide insights into the strength behind price movements.

Analyzing Trends: By monitoring open interest alongside price action, traders can gauge whether a market movement is gaining or losing strength. An increasing open interest in a rising market suggests that the upward trend may have strong backing and could continue.

Indicator of Participation: A significant increase in open interest indicates that new money is flowing into the market, potentially leading to significant price movements. It suggests that the current price trend is likely to continue, as new or existing traders are adding to positions.

WunderTrading gives traders the tools they need to easily find and take advantage of trading chances in the crypto market. With trade signals, traders can make smarter choices without the need to keep an eye on the market all the time.

Benefits of Trade Signals: These signals provide tips and advice on when might be the best times to buy or sell, thanks to detailed market analysis. This helps traders spot the best chances to make a trade.

Automating Strategies: With the platform‘s crypto trading bot, traders can set their trading to run automatically following these signals. This means they can make trades any time, day or night, without having to do everything themselves, which could lead to bigger profits.