Are We in a Recession? Signs of Economic Decline

This article is made for ordinary people and small investors, the most vulnerable audience when it comes to the recession. We will try to examine what happens on the markets right now and in the world economy and try to understand how to behave in such uncertain conditions. We will also examine the so-called safe havens in such times to survive, to save your capital or even to make some profits. It is widely believed that during the recession rich people become even richer while the poor become poorer. Let's try to find out how to benefit from the financial turmoil and how to make money during the recession.

Key Reasons Behind the Economic Shock

Coronavirus Pandemic and Its Impact on the Global Economy

Coronavirus disease (COVID-19) is an infectious disease that started in China and by the end of Q1 2020 covered all continents and almost all countries of the world. Chinese government managed to overcome the problem relatively fast compared to many other countries. Complete disaster is seen in European countries like Italy, Spain, France, etc. A number of deaths in Italy became larger than it was in China with numbers times fewer people infected.

Coronavirus forced most governments to close the borders, shut down airports, railway and other gateways for civil passengers.

Oil Crisis and OPEC: How Energy Markets Reacted

Long story short Saudi Arabians and Russians got into a conflict. In early March 2020, OPEC presented an ultimatum to Russia to cut production by 1.5% of world supply. The offer was rejected by Russia. As global oil production was kept at high levels, the demand for black gold was decreasing due to Coronavirus affecting economies across the globe. As a result market prices of oil went down.

Stock Market Crash: What Led to the Collapse?

From March 9 of 2020, stock markets including Dow Jones Industrial Average(DJIA) had record-setting drops, followed by two more record-setting drops on March 12 and 16. Other indices, including S&P 500, NASDAQ, FTSE100, DAX followed the crash. Economies of most countries literally stopped functioning, most industries were not simply affected by coronavirus but got paralyzed. Tourism, Civil Transportation (especially aviation) stopped functioning. Consumption fell significantly, unemployment increased dramatically. As of February 2020 unemployment rate in the US was the lowest for the past decade, while in March as Coronovirus affected the US, the unemployment rate was predicted at 30%, which is nearly 10 times just in one month. Needless to mention the impact it will make for the US. A similar situation is seen across other countries across the globe.

Gold Market Fluctuations: A Safe Haven or a Risk?

Stock markets crashed at about 25-30%. Many trading houses are trading using leverage, thus when such crashes take place, you will need to fund the losses. Thus, all assets you have will be used for that purpose. Gold is a great diversification asset, known as a safe haven, saw significant fall as liquidations of stock markets had to be closed.

Bitcoin Crash: How Crypto Reacts to Economic Uncertainty

Bitcoin followed a scenario of the gold in a magnified way. In the period between the 3rd and the 13th of March crypto gold dropped by -50%. Such a sharp decline triggered massive position liquidation ($1 billion according to Cointelegraph) on the top derivative exchanges. At the same time, the crash caused several technical issues on crypto exchanges themselves restricting the trading for a short period of time. This crash clearly represented the high volatility of the immature crypto market and highlighted the high risk associated with the crypto investment.

What Happens During an Economic Recession? Key Effects on Society

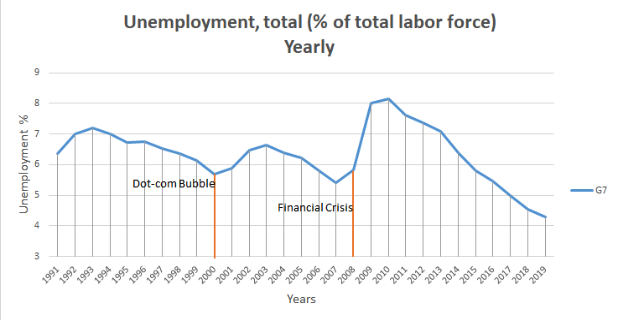

The typical outcome of the recession is the increase in unemployment level, decrease in the GDP on the local and global scales and this is exactly what was happening during the two most recent recessions (Figure 1).

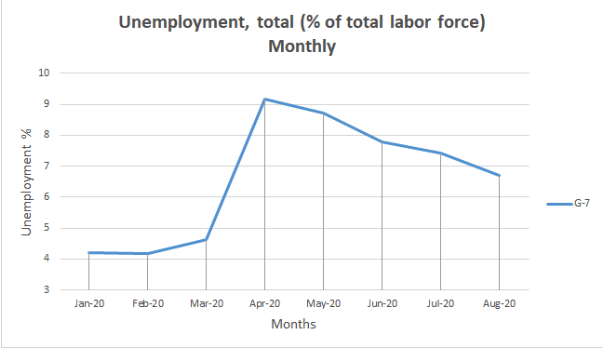

The sequence of events that unfolded in March 2020 (Oil, Stocks, Gold, Bitcoin crashes) and the increasing uncertainty for the businesses (particularly for the Leisure and hospitality industry) triggered the turmoil period for the economy. As a result, some businesses were forced to shut down while others were trying to optimise their workforce and lay off some of their workers increasing the unemployment Figure 2.

Quick Fixes for the Economy: Can Stimulus Packages Help?

On 15th March 2020, the US fed Reserve announced unlimited quantitative easing. Such an announcement assisted the stock markets to perform the V-shape recovery after the initial external shock.

Quantitative easing (QE) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment. It was first used as a monetary measure to assist the economy by Japan in the 1990s. There was a lot of debate whether such measures of essentially printing money should be employed. In 2008 the global recession was taking all over the world. Most developed countries used QE to stimulate the economy. Problems of growing government debts didn't disappear, but things moved on, and it's been 12 years since then. Today, in 2020, as coronavirus damaged the economies, governments of developed countries announced plans to use QE.

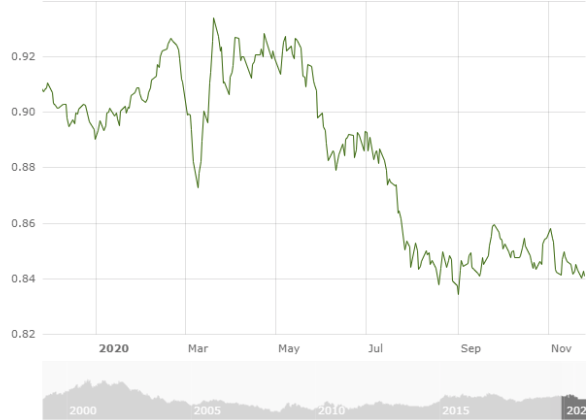

This measure stimulated the economies in the short run, however, it takes time for the money to reach capital markets, and once this happens the result will be - a depreciation of the currency. Let’s look at the example of the unlimited QE announced by the US government and the effect in the short and long run for the US dollar. In the graph below you can clearly see that after the announcement on the 15th of March the dollar became stronger against the euro and went back to the level of 0.91. It stayed there for about 3 months after which the depreciation started.

Why Can’t Governments Print Money Forever? Inflation and Consequences

Like all mechanisms, QE has its own drawbacks. Firstly, since the policy creates money and uses this money to increase lending by using this money as a reserve, this will undoubtedly increase inflation. That means that in the crisis scenario this solution solves one problem but creates another. Secondly, the exuberance of money may lead to an increase in the asset prices as soon as this money will find their way to the asset market, resulting in the appreciation of the assets. The continuation of the stimulus will support the inflow of money into the asset market, potentially creating the bubble. However, as soon as the stimulus will stop the bubble may burst. Thirdly, is the depreciation of the currency. Let’s look at the example of the unlimited QE announced by the US government and the effect in the short and long run for the US dollar. In the graph below you can clearly see that after the announcement on the 15th of March the dollar became stronger against the euro and went back to the level of 0.91. It stayed there for about 3 months after which the depreciation started.

USD vs EUR: How Major Currencies React in a Recession

How to Survive a Recession: Financial Strategies for Tough Times

The main goal of investment during the recession is to make sure that your funds do not lose value. For this purpose, you need to select the assets or stocks that are less volatile and make sure that you have a diversified portfolio with a low correlation between the assets.

- Precious metals. Gold or silver are usually counted as the number one assets during the recession as they are not that volatile and act as a good store of value for your funds during the crisis.

- Stocks with reliable dividends. Recession does not mean that you have to give up on the stock investment completely. It just means that you will probably have to change the approach. During the crisis, it is important to invest in stocks of the companies with reliable dividends and identify companies which do not heavily rely on the economic cycles. Upon receiving the dividends you can re-invest them if the stocks will fall, or take part of the profit out of the stock will be stable over the period.

- Real estate investment. During the recession period, the property market is depreciating and creates the opportunity for the potential investors to get into the market with the idea of receiving passive income through renting out the property or selling it later when the economy recovers.

- Crypto Lending. While the recession is the bad time for some long term investors it is a great opportunity for traders on the market. Using the cryptocurrency exchanges you can lend these traders stablecoins that are backed by the actual assets like USDT backed one-to-one to USD with the annualized interest of around 7%.

- Buy Bitcoin. Bitcoin is often referred to as digital gold. Despite its significant volatility Bitcoin has shown a high growth during the past 10 years. It is reasonable to diversify your portfolio by adding at least some amount of Bitcoin.

- DCA bot. Regularly invest a small amount in your chosen asset each month, for example.