Introduction to Trading

Trading involves the buying and selling of financial assets, such as currencies, stocks, and commodities, with the goal of making a profit. To be successful in trading, it’s essential to understand the basics, including risk management, position sizing, and market analysis. Professional traders rely on various tools, such as position sizing calculators, to make informed trading decisions.

A key aspect of trading is managing risk, which involves determining the maximum amount of risk to take on a single trade. Proper position sizing is crucial, as it helps traders avoid taking on too much risk and maximize their potential returns. Trading requires a combination of technical and fundamental analysis, as well as a solid understanding of market dynamics.

Traders must also manage their emotions and make rational decisions, even in times of high market volatility. The use of leverage in trading can amplify potential gains, but it also increases the risk of significant losses. To mitigate this risk, traders must carefully calculate their position size and set stop-loss levels to limit potential losses.

By understanding the fundamentals of trading and using the right tools, traders can increase their chances of success in the markets.

Why Risk and Money Management Matters

Risk and money management form the backbone of consistent profitability in trading. Here’s why they are vital:

-

Protects Your Portfolio:

-

Without proper risk management, a few bad trades can wipe out your entire portfolio. By limiting the percentage of your portfolio at risk per trade (e.g., 1%), you minimize the impact of losses. Additionally, considering broker fees is crucial as they can significantly affect overall trading costs and risk management strategies.

-

Reduces Emotional Decisions:

-

When you know the exact amount you’re risking, you’re less likely to make impulsive decisions driven by fear or greed.

-

Ensures Stability:

-

Trading is a marathon, not a sprint. Proper money management ensures you can survive market downturns and remain in the game for the long term.

-

Improves Discipline:

-

Following a consistent risk management strategy keeps you aligned with your trading plan and reduces unnecessary risk-taking.

Understanding Risk Management

Risk management is a critical component of trading, as it helps traders minimize their potential losses and maximize their returns. Effective risk management involves determining the maximum amount of risk to take on a single trade and setting stop-loss levels to limit potential losses. Traders must also consider their overall risk tolerance and adjust their position size accordingly.

A position sizing calculator can be a useful tool in risk management, as it helps traders determine the optimal position size based on their account size and risk percentage. Risk management is not just about limiting losses but also about maximizing gains by taking on the right amount of risk. Traders must balance their risk and reward, taking on enough risk to generate significant returns while minimizing their potential losses.

A key aspect of risk management is diversification, which involves spreading risk across multiple assets to minimize exposure to any one particular market. Traders must also be able to adapt to changing market conditions, adjusting their risk management strategy as needed. By prioritizing risk management, traders can increase their chances of long-term success in the markets.

Effective risk management requires a combination of technical analysis, fundamental analysis, and market experience.

What Is a Position Size Calculator?

A position size calculator is a tool that helps traders determine the correct trade size based on their:

-

Portfolio size: The total value of their trading account.

-

Risk tolerance: The maximum percentage of the portfolio they’re willing to risk on a single trade.

-

Stop-loss level: The distance between the entry price and the stop-loss price.

-

Currency pair: The specific pair of currencies being traded.

Using these inputs, the calculator helps determine the appropriate amount of currency units to buy or sell, ensuring the maximum potential loss stays within the trader’s predefined risk limits.

To use the calculator, traders need to enter relevant data such as their account size, risk tolerance, stop-loss level, and the currency pair they are trading. Accurate information is crucial for the calculator to suggest optimal position sizes, thereby enhancing risk management strategies.

Calculating Position Size

Calculating position size is a critical step in trading, as it helps traders determine the optimal amount of capital to risk on a single trade. A position sizing calculator can be a useful tool in this process, as it takes into account the trader’s account size, risk percentage, and stop-loss level.

To calculate position size, traders must first determine their risk percentage, which is the percentage of their account equity that they are willing to risk on a single trade. They must then set a stop-loss level, which is the price at which they will exit the trade if it moves against them. The position sizing calculator can then be used to determine the optimal position size based on these inputs.

Traders must also consider their trade size, which is the amount of capital they will allocate to a particular trade. The trade size will depend on the trader’s account size, risk tolerance, and market analysis. By carefully calculating their position size, traders can minimize their potential losses and maximize their returns.

A key aspect of calculating position size is determining the maximum risk per trade, which is the maximum amount of capital that can be lost on a single trade. By using a position sizing calculator and carefully managing their risk, traders can increase their chances of success in the markets.

How the Calculator Works

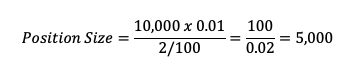

The formula for calculating position size is crucial for effective money management and risk control in Forex trading. Accurate calculations are essential to determine the correct position size, which can prevent significant financial losses and contribute to organized trading skills.

Traders can find the optimal position size using a position size calculator, which helps in making informed decisions by providing tailored suggestions based on specific inputs.

Inputs Explained:

-

Portfolio Size: The total value of your trading account. For example, $10,000.

-

Risk %: The percentage of your portfolio you’re willing to risk (e.g., 1%).

-

Stop Loss %: The difference between your entry price and stop-loss price, expressed as a percentage.

It is important to enter the correct information into the position size calculator to ensure accurate results. This practice is fundamental for effective risk management and professional trading.

Example:

-

Portfolio Size: $10,000

-

Risk %: 1% (Max risk = $100)

-

Entry Price: $50

-

Stop Loss Price: $49 (Stop Loss % = 2%)

In this example, the trader should allocate $5000 to the trade, which translates to the appropriate number of lots, to ensure their maximum loss remains at $100. Calculating position size correctly when traders open new positions is essential for effective money management and risk control.

The position size calculator provides users with optimal position sizes based on the specific inputs they enter, ensuring effective risk management. It helps determine the appropriate amount of currency units to buy or sell, thereby aiding in organized and professional trading.

Benefits of Following Risk Management Rules

-

Prevents Overtrading:

-

Trading too large a position can lead to excessive losses. A position size calculator keeps you within safe limits. In forex trading, calculating position sizes and pip values is crucial to minimize losses and maximize profitability.

-

Mitigates the Impact of Losing Streaks:

-

Even the best traders face losing streaks. By limiting your risk per trade, you ensure your account survives during tough times.

-

Encourages Consistency:

-

Consistent trade sizing prevents disproportionate losses from one poorly planned trade.

-

Reduces Psychological Stress:

-

Knowing your risk is predefined removes anxiety, allowing you to focus on strategy and execution.

Why Traders Often Ignore These Rules

Despite the clear benefits, many traders fail to follow risk management principles due to:

-

Overconfidence: Believing their analysis guarantees a win.

-

Chasing Losses: Increasing trade sizes to recover losses quickly.

-

Greed: Risking too much in hopes of massive returns.

Ignoring risk management often leads to catastrophic losses, reinforcing the importance of discipline.

Conclusion: Make Risk Management Non-Negotiable

WunderTrading takes risk and money management to the next level by offering seamless tools for auto trading that integrate directly with your trading strategies. With built-in support for automated bots and advanced risk management settings, it ensures that every trade adheres to your predefined risk tolerance. Whether you're using a position size calculator or setting stop-loss levels, WunderTrading empowers you to execute strategies efficiently while maintaining control over your portfolio. It's the ideal platform for traders looking to combine automation with disciplined trading practices.

A position size calculator is not just a tool; it's a safeguard for your trading journey. By ensuring your maximum loss remains within your risk tolerance, it allows you to trade confidently and sustainably.

Risk management is the cornerstone of successful trading. Always remember: it's not about how much you make in one trade, but how well you protect your capital over time.

Start using a position size calculator today and take control of your trades for a safer, more disciplined trading experience!

The Position Size Calculator is freely accessible on Google Sheets.