Introduction to Crypto Investing

Crypto investing can be a lucrative venture, but it requires a well-thought-out strategy to navigate the volatile market. One popular approach is dollar-cost averaging (DCA), which involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy helps to reduce the impact of market fluctuations and timing risks, making it an attractive option for both new and experienced investors. By adopting a DCA strategy, investors can build wealth over time and minimize the effects of price volatility. This consistent investment approach allows investors to accumulate assets gradually, without the stress of trying to time the market perfectly.

How does DCA crypto strategy work?

The DCA crypto strategy works by investing a fixed amount of money at regular intervals, such as weekly or monthly, into a cryptocurrency like Bitcoin or Ethereum. This approach helps to reduce the impact of market volatility, as the investor is not trying to time the market or make emotional decisions based on short-term price fluctuations. Instead, the investor is making consistent, regular contributions to their investment portfolio, which can help to lower the average purchase price over time. By using a DCA strategy, investors can also avoid the risks associated with lump sum investing, such as investing a large sum of money at the wrong time. This disciplined approach ensures that investors are buying more units when prices are low and fewer units when prices are high, leading to a potentially lower average purchase price.

What is the best time to start DCA strategy

The best time to start a DCA strategy is when you have a long-term investment horizon and a consistent financial situation. This approach is particularly useful for investors who want to build wealth over time and minimize the effects of market volatility. By starting a DCA strategy early, investors can take advantage of the power of compounding and potentially lower their average purchase price over time. It’s also important to consider your risk tolerance and financial situation before starting a DCA strategy, as this will help you determine the right investment amount and frequency for your needs. Whether the market is at a peak or experiencing a dip, the key is to invest regularly and stay committed to your investment plan.

Benefits of crypto DCA

The benefits of crypto DCA include reduced market volatility risk, lower average purchase price, and increased potential for long-term wealth building. By investing a fixed amount of money at regular intervals, investors can minimize the effects of price fluctuations and make consistent, regular contributions to their investment portfolio. Additionally, a DCA strategy can help investors avoid emotional decisions based on short-term market movements, which can be detrimental to their investment portfolio. Other benefits of crypto DCA include the potential for higher returns over the long-term, reduced risk of lump sum investing, and increased discipline and consistency in investment decisions. This strategy-based approach helps protect investors from the unpredictable nature of the crypto market, ensuring a more stable and predictable path to building wealth.

How does DCA crypto strategy works?

Dollar cost averaging (DCA) refers to the recurring purchase of a smaller number of assets within a specified time interval no matter how the asset's price changes, instead of lump sum investing. Generally, most people try to buy during a short-term market downturn and bear market. Implementing the DCA crypto strategy can reduce the risk of investing too much money at once and losing a high fraction of investment by mal prediction of the entrance time.

To use DCA, you first need to decide how much money you are willing to invest, and then you need to buy a smaller equivalent amount of money within a specific period of time instead of investing all the money at once. It is possible that you will buy when the Bitcoin transaction reaches its highest point in history, or you may buy it at a low price after the market has sold off. Looking at a longer period, the average price of all BTC in your wallet will balance between the top and bottom. This approach can lead to a lower average cost over time.

What is the best time to start DCA strategy

In the last year, the bitcoin price raised suddenly from below 4,000 USD in March 2020, up to 61,000 USD. So far, the Bitcoin transaction price is above 50,000 USD, which records a full increase of 1150% from March 2020. For those who have been active in the market, it has provided a huge profit opportunity, but for those who are still waiting for the time to enter the market, it is just another missed opportunity to get on the car.

The problem with the timing of the crypto market entry is to watch an asset trade at a historical high and wait for the lower levels to enter the trade. But there is no way to really know when the lower limit will come or when it will pass. If bitcoin has fallen by 12% in two days, does this mean it is time to buy or should we wait for the further drop? If we are looking for traditional value investing or buying at dip strategies, it will be hard to find any entry point. Therefore, when others are already over the moon, the crypto novices have repeatedly missed entrance opportunities and also lost because of buying at high prices. At these periods of time, in which there is a huge tendency toward trading the cryptocurrencies, and there is no way to predict a good entrance point based on traditional strategies of trading, we can reduce the risk of all-in at high prices by entering the market at different time intervals. This idea is the backbone of Dollar Cost Averaging (DCA) trading bots.

However, starting a DCA strategy during a market peak can still pose risks. While DCA helps mitigate some risks, it does not protect against significant losses that can occur if the market declines sharply after reaching a peak. Active risk management strategies are essential to navigate such scenarios effectively.

Benefits of crypto DCA

DCA (dollar cost averaging) is generally advantageous for investing in volatile crypto assets. It allows you to buy at low prices and sell at high prices, but of course, there are a couple of disadvantages. In an extreme bull market, such as the past four months, it may be better to invest lump sum amount at once than the average price over time. But again, this kind of summary can usually only be drawn after the fact. Neither you nor any crypto investor who claims to be a legend in technical analysis knows this in advance.

The real purpose of DCA is to reduce risk at crypto investing in volatile markets. Depending on your market performance when you make a scheduled purchase, DCA may make you reduce your losses, or it may help you increase your gains. DCA tries to prevent you from buying at the top and sustaining losses for a long time. Perhaps the real benefit of DCA is that it reduces the emotional pressure of all-in at a single price.

DCA is one of the most effective investment strategies for managing risk in the crypto market.

As the risk decreases, the return will decrease, but if you are a long-term optimist about Bitcoin and are just looking for a way to easily holding it, then when you buy the first Bitcoin, the dollar cost averaging strategy is worth considering.

Drawbacks of DCA crypto

Although the cost averaging method is a profitable strategy, some people are sceptical of it due to its potential drawbacks, especially in a rising market. It performs best when the market experiences large volatility because the strategy is to mitigate the impact of high volatility on positions. But according to some people, when the market is performing well, this strategy will make investors lose profits. If the market is in a sustained bull market trend, it can be assumed that those who invested earlier will get better results. In this condition, the cost averaging method will inhibit the gains in the upward trend, and the one-time lump sum investment may exceed the gains of the averaging cost method.

By the way, for most of the crypto investors who do not have a large amount of capital to make a one-time investment, the average dollar cost is a suitable strategy.

How to test the results of DCA bots performance before investing

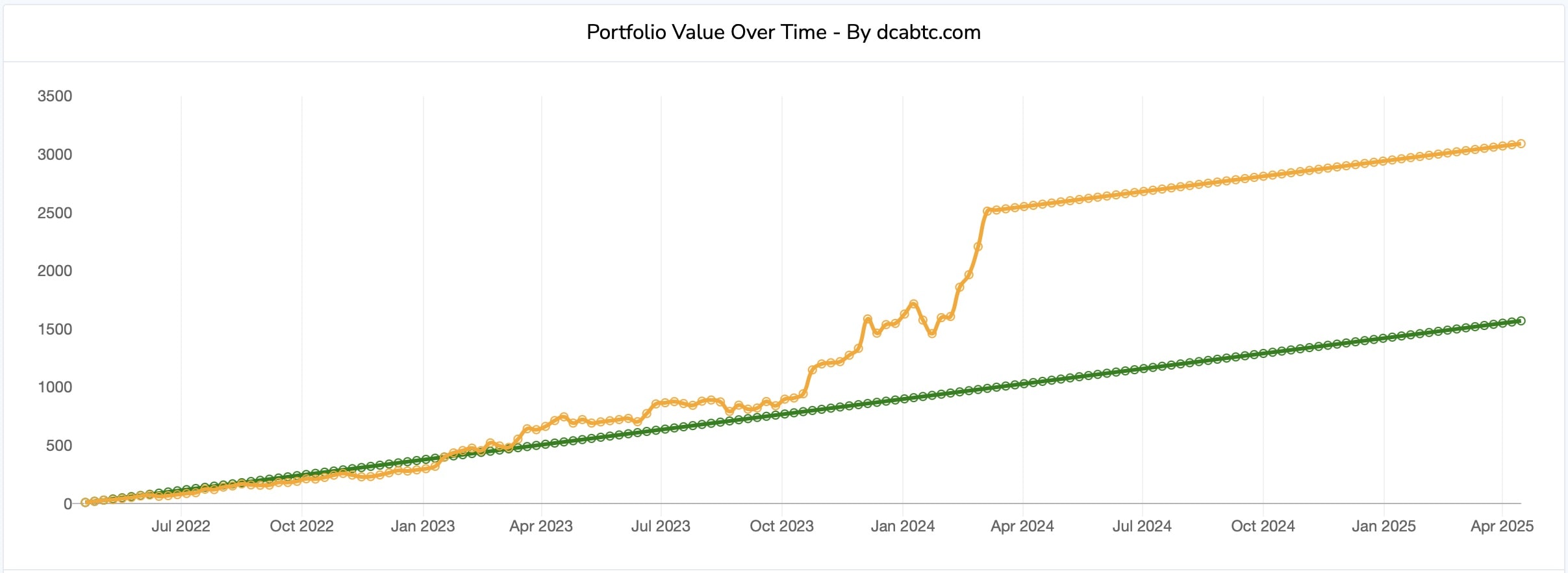

You can find a concise version of the Bitcoin dollar cost averaging performance bot Calculator on dcabtc.com. DCA bots facilitate recurring buys, allowing for consistent investment over time. You can specify the number, time range, interval, and parameters to modify the strategies during a specified time period. By optimizing the parameters, you can have a backtest on the crypto automation strategy and find the result of gradual entrance to the market with DCA bots.

Figure 1. DCA Bot’s performance results, starting from five years ago.

As an example, if you have bought $10 worth of Bitcoin every week in the past five years, the graph below shows your investment performance. $10 per week does not seem to be much, but by April 2021, your total investment will be about $2600, and your bitcoin investment will be worth about $62,000.

How to apply DCA bots?

WunderTrading – an automated trading platform, allows you to use the DCA (dollar cost averaging) principles in bots manual trading, as well as automated, meaning you can apply it to any crypto trading bot that you employ. Implementing DCA with bots can streamline the investment process. Try the DCA bot now. At WunderTrading users can apply DCA trading bot to any integrated crypto exchange, including Binance, Bybit, Deribit, Kucoin, OKX, BitMEX, coinbase pro, Huobi, Kraken, etc. While DCA bots reduce the need for active management, advanced tactics may still require ongoing oversight. Other features of WunderTrading include arbitrage and futures spread trading terminal, multiple account management, copy-trading (also known as mirror trading). Advanced analytics of orders and portfolio are available for all users.

To sum up

The cost averaging method is a redemption strategy for establishing positions, which can minimize the impact of volatility on investment. It can be particularly effective in volatile market conditions, helping to mitigate risks. It divides the investment into smaller parts and buys each part regularly. The DCA bots, give you the chance to enter the market at the local minimum points in specific time periods.