That’s why the introduction of the new “Two Leg Entry” feature for spreads and arbitrage trading is such an exciting development. This feature allows traders to execute spread trades with greater precision, using limit orders to reduce trading fees and improve execution speed. In this article, we will take a closer look at the “Two Leg Entry” feature in crypto pairs trading and explore its benefits for traders looking to optimize their spread trading strategies. If you want to improve your knowledge of trading financial instruments and trading crypto pairs specifically, this article is for you.

Introduction to Crypto Trading

Crypto trading is the process of exchanging digital assets, such as cryptocurrencies, on a trading platform with the goal of profiting from price movements in the market. To get started with crypto trading, it’s essential to understand the concept of trading pairs. A trading pair consists of two different digital assets that can be exchanged for each other. The first currency listed in a trading pair is known as the base currency, while the second currency is the quote currency. For example, in the trading pair BTC/USDT, Bitcoin (BTC) is the base currency, and Tether (USDT) is the quote currency. By understanding how trading pairs work, traders can make informed decisions and capitalize on market opportunities.

What is Crypto Pairs Trading?

First of all, it is important to understand what a cryptocurrency trading pairs is and how to work with it. Crypto trading pairs is a strategy where a trader tries to profit from the difference between the prices of two digital assets. In the context of cryptocurrencies, this could be, for example, the difference between the price of Bitcoin and Ethereum. Interestingly, the spread can be both positive and negative. A positive futures spread arises when the price of one asset exceeds the price of another, and a negative futures spread when the price of the first asset is lower than the price of the second. This allows traders to exchange one cryptocurrency for another, leveraging the relative values between them.

Trading pairs on a cryptocurrency exchange has many advantages. Firstly, it allows traders to make profits in any market conditions, including during a crisis. Secondly, trading cryptocurrency pairs is more predictable than traditional cryptocurrency market trading because it does not depend on the overall direction of the market. Understanding common trading pairs is crucial as they represent the comparative value between two digital assets, helping traders to analyze the market and diversify their portfolios. These pairs are highly valued as they enable traders to understand the value of different cryptocurrencies and enhance their trading strategies.

TradingView pairs trading example.

To see the spread chart, you need to divide the price of one asset by the price of the second asset. For example, here is what the Bitcoin and Ethereum spread chart would look like (see TradingView pairs trading chart).

When trading on the spread chart, we will make 4 trades. We will always buy one asset and sell the other. For example, to enter a long position on this spread chart, we will buy Bitcoin and sell Ethereum. To enter a short position, we will sell Bitcoin and buy Ethereum. In total, we will have 4 trades - 2 for opening and 2 for closing. Opening and closing these trades at the market price will always reduce the profit because the commissions for 4 trades will often exceed the profit from the spread trade.

In order to reduce the commission from trades and increase profit, we have added the “Two Leg Entry’’ feature for paired trading spreads. Go to the WunderTrading platform and open the terminal. Switch to the “Spreads & Arbitrage” mode and select “Two Leg Entry”.

How do Crypto Trading Pairs Work?

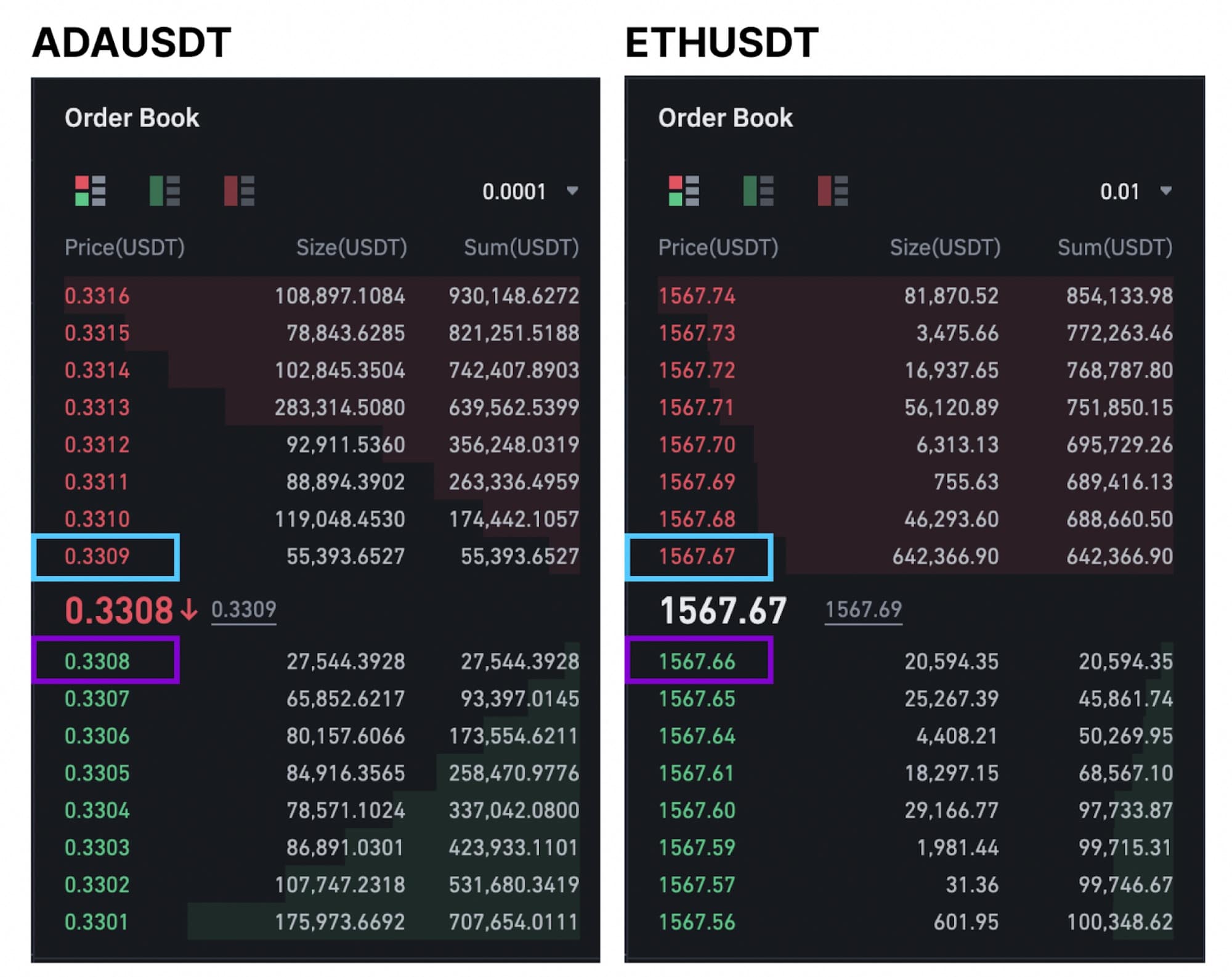

Let’s consider an example to understand how “Two Leg Entry” works. If we are trading in long spread ADAUSDT/ETHUSDT, the first limit order will be placed at the nearest BID offer in the ADAUSDT order book, which we have highlighted in purple, and the second limit order will be placed at the nearest ASK offer in the ETHUSDT order book, which we have highlighted in blue. Then the system will wait until at least one limit order is executed. Once one limit order is executed, the other limit order on the other leg will be cancelled, and a market order on this leg will be executed to fix the spread price.

Exiting the position will be similar, but unlike entry, a take-profit/stop-loss will be used as a stop price for exit.

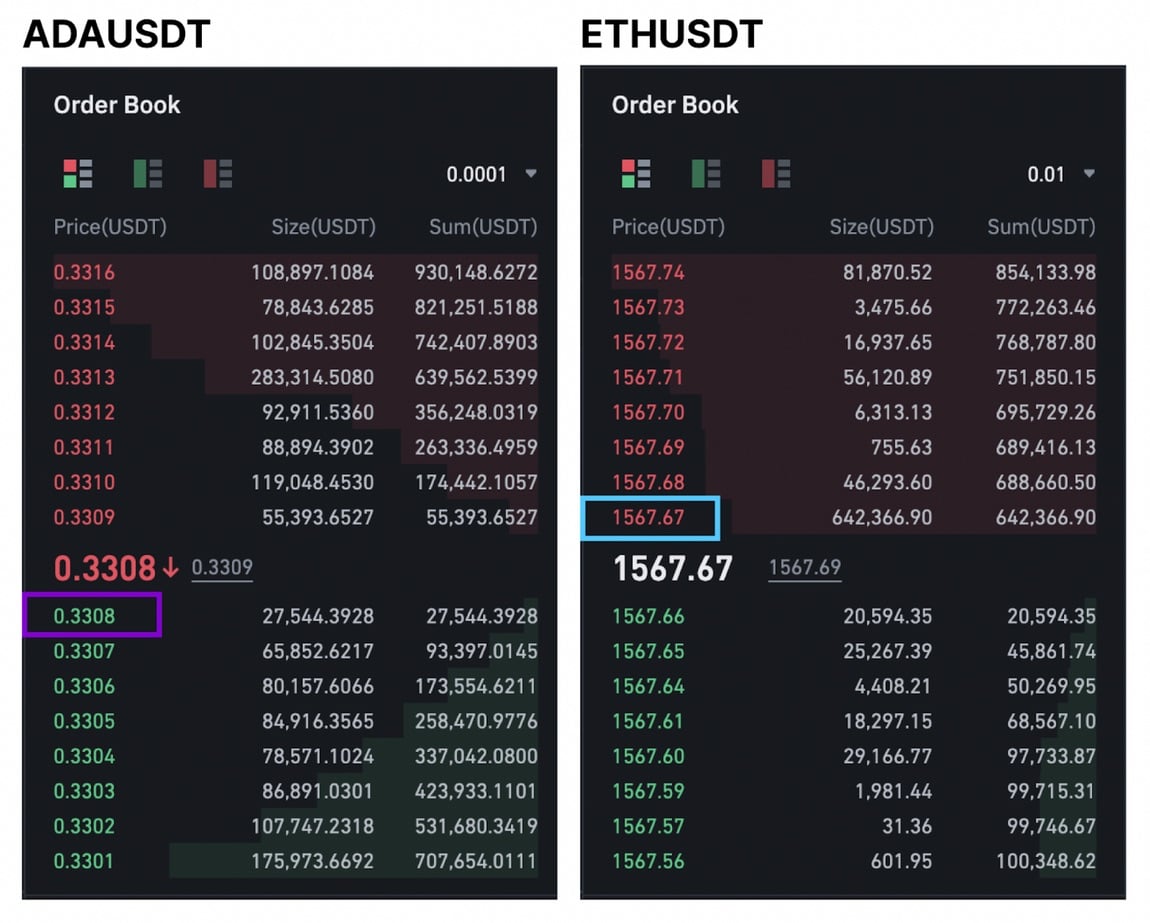

In order to open a trade on the platform, let’s go to the “Spreads & Arbitrage” mode on the terminal and select “Two Leg Entry”. Choose the trading pairs, set the necessary settings, and execute the trade. For buying, the stop order price should be below the current price, and for selling, it should be above the price.

When opening a trade on the platform, you can see that one trade is in a buying position, while the other is waiting for selling. In the order books of the selected coins, it will look like this.

One limit order will be placed below the set stop price for buying, and the second order will be above the stop price for selling. When one of the limit orders is triggered, the second order will be executed at market price, thereby forming the futures spread. When trading spreads using the “Two Leg Entry” feature, we can achieve maximum accuracy in order execution and reduce fees by using limit orders. By analyzing market data through technical analysis and observing price charts, traders can visualize the spread and understand the significance of trading volume in the order book data. The assets being traded are exchanged efficiently, ensuring optimal trading conditions.

In conclusion, WunderTrading’s pairs trading software has a Two Way Spread Entry feature that is a powerful tool for traders who want to make more accurate trades with lower fees. By using limit orders instead of market orders, traders can open and close positions with greater accuracy and minimize slippage. With the ability to customize settings and choose from a wide range of trading pairs, the Two-Way Entry feature offers traders more flexibility in their trading strategies. If you are a trader looking to improve your futures spread trading, be sure to check out this exciting new feature on the WunderTrading pairs trading platform.

Mean Reversion in Trading

Mean reversion is a key concept in trading that refers to the tendency of asset prices to revert to their long-term equilibrium. In the context of pairs trading, mean reversion is essential as it enables traders to profit from the price difference between two cointegrated assets. Mean reversion strategies are based on the idea that asset prices will fluctuate around a long-term mean, and by trading on these fluctuations, traders can profit from the price movements. To implement a mean reversion strategy, traders need to identify two cointegrated assets and calculate the spread between them. By monitoring the spread and trading on its fluctuations, traders can effectively capitalize on price movements and achieve profitable trades.

Fiat Currencies in Trading

Fiat currencies, such as the US dollar, play a crucial role in crypto trading. These currencies are used as a reference asset to value digital assets and settle trades. In crypto trading, fiat currencies are often used to buy and sell digital assets, providing a stable benchmark against which the value of cryptocurrencies can be measured. For example, a trader might buy Bitcoin (BTC) with US dollars and later sell it for Tether (USDT) to profit from the price difference. Fiat currencies are also integral to pairs trading strategies, where they serve as a reference asset to value the spread between two digital assets. Understanding the role of fiat currencies in trading is essential for any trader, as it helps them navigate the market and make informed trading decisions.

To learn in detail on how to use the Two-leg entry with WunderTrading follow the guide.

If you are a newcomer to WunderTrading, enjoy free pairs trading software for 7 days.